The Source

Your Culture. Your Benefits. Our Connection.

We’re all about creating a culture that’s member-focused, collaborative, and service-oriented. Since 1954, we’ve been committed to serving our members and supporting our employees, empowering our team with opportunities for growth, meaningful training, and comprehensive benefits that prioritize their well-being.

Our culture is built on integrity, service, and problem-solving excellence, with teamwork and cross-department collaboration at its core. We believe in continuous improvement, encouraging employees to share ideas, challenge the status quo, and help us stay adaptable, inclusive, and responsive to the needs of our community.

Our mission is simple: Provide an outstanding banking experience that puts people first. Guided by our values, Inclusive, Genuine, Adaptable, and Committed and our belief in Love Where You Work, we’re dedicated to supporting one another while delivering exceptional service to our members and the communities we serve.

New Hire Enrollment

Taking care of our own has always been at the heart of who we are, our members, our community, our employees, and their families.

Families don’t always look the same. It’s grown and evolved and so have we. Employees can now extend select benefits, like our Employee Assistance Program and Regence Employer resources, to those outside the traditional definition of family. Getting healthy and staying well is easier when you’re surrounded by the people who matter most, no matter the relationship.

We offer a comprehensive benefits package designed to support your health, well-being, and financial future, including medical, dental, vision, disability, life/AD&D coverage, and a generous retirement contribution that helps you build lasting security.

You’ll be eligible to enroll in benefits starting on the first of the month. Our HR team will connect with you during your first week to walk you through your options and help you get started.

Eligibility for our 401(k) plan begins after six months of employment.

We’re here to help you build a strong foundation for your future and can’t wait to see you thrive as part of our team.

Benefits Eligibility

You are eligible to enroll for benefits if you are a full-time employee who is regularly scheduled to work 30 or more hours per week.

Dependent Eligibility

If you are eligible to elect coverage for yourself, you may also elect coverage for your eligible dependents. Your eligible dependents include:

• Your legal spouse or registered domestic partner.

• Your children up to age 26 (25 years old or younger) - including biological children, stepchildren, adopted children, children whose legal guardianship has been granted to you by the state.

• Your unmarried child age 26 and older who depends solely on you for your support because of a mental or physical disability where the disability arose before age 26 (documentation is required).

Plan Documents: This website provides a highlight of your benefits. If any statement on this website conflicts with any applicable plan documents, the plan documents will govern. Plan provisions may be changed or deleted in order to meet any state or legal requirements. CCCU reserves the right to amend or terminate benefits as it deems necessary at any time. Failure to complete eligibility and other required documents may make employees ineligible for benefits coverage.

Insurance Plans

Regence 1000

A copay plan with a lower annual deductible, but higher monthly premiums.

Note: Copays are in addition to annual deductibles.

$1,000 Deductible, Employee Only

$2,000 with Dependents

Regence 3500 HSA (HDHP)

* New Lower Deductible for 2026! *

A High Deductible Health Plan (HDHP) option has lower monthly premiums but higher upfront costs before coverage kicks in. A Health Savings Account (HSA) with an employer contribution is paired with this plan to help cover out-of-pocket costs.

$3,500 Deductible, Employee Only

$7,000 with Dependents

New to Regence?

If you or your dependents are new to Regence, you will receive a new ID card in the mail. It will come in a plain envelope, so don’t throw it away! Have it handy and create an account at Regence.com or on the Regence app. This will allow you to easily access all the tools and resources that come with your membership.

Who can provide me with Healthcare?

Choosing in-network providers and pharmacies is a great way to lower out-of-pocket expenses. Out-of-network providers do not have agreed upon pricing with Regence. Wherever you decide to receive care, requesting an estimate prior to services makes good financial sense.Get the Regence App!

For added convenience, download the

app for your iPhone or Android.

Need a Provider?

Check out the directory of participating healthcare providers within the Regence network.

Understanding Health Insurance

Need help understanding health insurance? We'll start at the beginning.

Learn everything you need to know about health insurance - including terminology, how insurance works, who pays what, and the importance of networks.

Which Care Options Fit My Needs?

Nurse Line

Consider for: Cold & flu, fever, minor burns and injuries.

Availability: 24/7

Avg. Cost: None

Avg. Wait Time: Short

Virtual & Telehealth Visits

Consider for: Allergies, anxiety & depression, cold & flu, UTIs.

Availability: 24/7

Avg. Cost: Low

Avg. Wait Time: Short

In-Home Urgent Medical Care

plan and where you live.

Consider for: Cuts & lacerations, infections, nausea & vomiting, sprains & strains.

Availability: Vary

Avg. Cost: Moderate

Avg. Wait Time: Moderate

Urgent Care Clinic

Consider for: Abdominal pain, migraines, sprains, strains & cuts.

Availability: Vary

Avg. Cost: Moderate

Avg. Wait Time: Moderate

Emergency Room

Consider for: Chest pain, major burns & injuries, shortness of breath, uncontrolled bleeding.

Availability: High

Avg. Cost: High

Avg. Wait Time: Long

Regence Plan Benefits

What I Pay

Physician Provider Services

Alternative Care

Acupuncture

In-Network

$30/Visit

Out-of-Network

$30/Visit

Regence 3500 HSA (HDHP):

20% After Deductible

Limit 30 visits/year

Chiropractic

In-Network

$30/Visit

Out-of-Network

$30/Visit

Regence 3500 HSA (HDHP):

20% After Deductible

Limit 30 visits/year

Alternative Care

In-Network

$30/Visit

Out-of-Network

40% Coinsurance

Regence 3500 HSA (HDHP):

20% After Deductible

Naturopath

Pro Tip: Get Insurance to Cover Your Massage Therapy

Did you know your Regence health plan may cover therapeutic massage? Follow these steps to ensure your massage is covered under your plan:

- Find an In-Network Provider

- Go to regence.com and search for a Licensed Massage Therapist (LMT) in your network.

- Contact the therapist to confirm they are in Regence's network of providers.

- Schedule for a Medical Condition

- Insurance does not cover massages for stress or relaxation. Be prepared to discuss a medical condition that justifies the massage therapy.

- Insurance does not cover massages for stress or relaxation. Be prepared to discuss a medical condition that justifies the massage therapy.

- Provide Your Insurance Card

- Although pre-authorization is not required, ask the LMT to call Regence to confirm coverage before your appointment. This ensures the massage will qualify for your plan’s benefits.

- Although pre-authorization is not required, ask the LMT to call Regence to confirm coverage before your appointment. This ensures the massage will qualify for your plan’s benefits.

- Request Pre-Authorization

- Know Your Plan Details

- Regence 1000: You'll pay a $30 copay for a covered massage.

-

- Regence 3500 Plan: Costs apply toward your deductible and out-of-pocket maximum.

Taking these steps can save you time, stress, and unexpected costs. Enjoy the benefits of massage therapy while keeping your coverage in check!

Emergency, Urgent Services, Hospital Services

Emergency

In-Network

$150/Visit

Out-of-Network

$150/Visit

Regence 3500 HSA (HDHP):

20% After Deductible

Urgent Services

In-Network

$30/Visit

Out-of-Network

40% Coinsurance

Regence 3500 HSA (HDHP):

20% After Deductible

Inpatient

In-Network

20% Coinsurance

Out-of-Network

40% Coinsurance

Regence 3500 HSA (HDHP):

20% After Deductible

Pregnancy Program

Get pregnancy and new-parent support with

our Pregnancy Program. Your maternity nurse care manager can answer all your questions,

plus, the program includes its own app to track milestones during pregnancy and baby’s first year.

DispatchHealth

DispatchHealth® can help your moderate- to high-risk patients by bringing urgent medical care to the comfort of their homes. Whether it is after hours, on weekends or holidays, or during times of high patient volume, you can

rely on DispatchHealth to help you deliver care.

To learn more about what to expect during a Dispatch Health visit, watch this video, call them at (503) 917-4904 or click below to visit their website.

DispatchHealth is available in Oregon Only.

Virtual & Telehealth Services

Hinge Health

Hinge Health is a new kind of digital clinic for joint and muscle pain - and it's all centered on you, your life, and your needs.

Hinge Health combines expert clinical care and advanced technology to help you move beyond pain, avoid unnecessary surgeries, and reduce opioid use.

Doctor on Demand

Visit a doctor or therapist via video chat. We all have times when we need to see a doctor, but it’s inconvenient – there’s no time, the office is closed, or we’re on the road.

You can talk to any of Doctor On Demand’s Board Certified Physicians, Licensed Counselors and Psychiatrists by video chat using your computer or the app – 7 days a week, 365 days a year.

Just a $10 copay for Doctor on Demand telehealth visits.

24/7 Nurse Line

Regence Advice24 is a 24/7 nurse line that provides immediate support for everyday health issues that otherwise might lead to unnecessary and expensive doctor or emergency room visits.

These registered nurses can advise you on common issues, such as:

- Vomiting & nausea

- Cuts & minor burns

- Viruses, coughing, dizziness & headaches

- Back pain

- Feverish baby

Regence Advice24

Chat

Click below to sign in to your Regence account and select 'Connect with a nurse 24/7'.

Available from 8:00 am - 8:00 pm PST

Behavioral Health Support

AbleTo Therapy+

8-week online therapy program with licensed therapists and digital support tools for those ages 18+.

Regence Care Management

Regence Care Management supports the unique needs of their members with acute, chronic and major illness episodes or severe illness conditions.

The mission of care management is to prioritize the needs of their members by providing personalized, equitable services that enhance their wellbeing.

- Advocating for members and their support systems

- Improving care through close collaboration with providers

- Supporting members transitioning to different levels of care

- Assisting members as they navigate the health care system

- Educating members about their care options, benefits and coverage

- Supplementing information given by providers to help members make educated decisions regarding their health care

Reward Program - Regence Empower

Whether you want to start a new fitness routine, improve your sleep habits or practice mindfulness, there is a program for you. Working on your health is more fun together,

so your spouse or partner can earn the same incentives as you do!

Get going today! Begin your well-being journey by taking the online Regence Empower Health Assessments. Then, throughout the year, you’ll have opportunities to earn rewards while building positive habits for your health.

GET REWARDS FOR BEING PROACTIVE:

You can earn up to $100 per year in gift cards for engaging in healthy activities that support your long-term health, like getting preventative exams and screenings. Your Regence health plan covers preventative care at no cost to you when you see an in-network provider.

READY TO GET STARTED

regence.com and select Regence Empower to start your well-being journey today.

Step 2: Download the app. You live life on the go. Keep your well-being journey at your fingertips by downloading the Regence Empower App.

Step 3: Engage today! Complete your Health Assessment, schedule your wellness exam and any necessary screenings, participate in challenges, track health activities and more.

Health Assessment

Preventative Wellness Exam

Breast & Cervical Cancer Screenings

Colorectal Cancer Screening

Vision Exam

Dental Visit

Health Tech

Health Learning Activities

Prescription Options

Prescription options for all Regence Health plans.

Tier 1

- $15 retail

- $45 home delivery

- $10 for each self-administrable Cancer Chemotherapy medication

Regence 3500 HSA (HDHP):

20% After Deductible

Tier 2

- $50 retail

- $150 home delivery

- $50 for each self-administrable Cancer Chemotherapy medication

Regence 3500 HSA (HDHP):

20% After Deductible

Tier 3

- $100 retail

- $300 home delivery

- $100 for each self-administrable Cancer Chemotherapy medication

Regence 3500 HSA (HDHP):

20% After Deductible

Insulin Cost Share Cap

Retail or delivery:

$35 for 30-day supply

$105 for 90-day supply

Regence 3500 HSA (HDHP):

Deductible Waived

Specialty Select

30-day Supply Retail

Refer to Tiers 1,2, and 3 for specialty drugs.

Prescription Info

Three Tier Drug List

Negotiated to save you more!

Optimum Value Medication List

Best Value - Some medications on this list are $0. Check if there are generics to your everyday medications by clicking the link above.

GoodRx

Mail-Order Delivery

Get medicine sent directly to your door with home delivery service.

Home delivery offers convenience to manage your long-term conditions, including:

- A 90-day supply of medicine and auto-refills (if applicable)

- Free standard shipping and 24/7 support from pharmacy experts.

Regence BCBS - Additional Guides & Information

Benefit Summary Classic

Regence HSA Healthplan 3.0

SBC 1000

SBC HSA

EAP Member Flyer

Oregon LG Open Enrollment Guide

Employee Engagement Flyer - Oregon

Find a Doc & Cost Estimator Flyer - OR

Employee Vaccine Flyer OR

RBCBS Oregon Health Insurance 101 Video Description Flyer

Behavioral Health Resource Flyer OR

Regence BCBS TalkSpace - Getting Started Guide

Doctor on Demand Virtual Office Visits

Advice24 Member Flyer - OR

Pharmacy Quick Guide Updates - OR

BCBSO Optimum Value Medication List

Blue Card Flyer - OR

Oregon LG FI Empower Core Roadmap

Regence Advantages Flyer - OR

ActiveFit Direct Regence Advantages

Hinge Health Regence OR

Regence Preventive Care Flyer

Regence Choice Vision 51+ Member Flyer

Vision & Dental Benefits

Dental Benefits

Health Savings Account (HSA)

CCCU has a Health Savings Account (HSA) with employer funding for employees enrolled in the Regence 3500 HSA (HDHP).

An HSA is tax-advantaged savings account that allows you to set aside money for medical expenses if you have a High Deductible Health Plan (HDHP). Contributions are made with pre-tax dollars, reducing your taxable income, and the funds grow tax-free. You can use the money for various healthcare costs, and any unspent funds roll over each year, making it a flexible way to save for current and future medical expenses.

Employees and/or enrolled dependents that are or will be Medicare eligible in 2026 should not sign up for the Regence 3500 plan. Once enrolled in Medicare, you can no longer make contributions to your Health Savings Account.

Interest and Investment Earnings are Tax-Free

HSA balances greater than $2,000 ear tax-free interest.

You can choose to invest your HSA balance in a variety of mutual funds and other options. Any investment earnings you receive are tax-free! With tax-free growth, your HSA is a powerful way to build savings for your healthcare. Log in to your account at HealthEquity to learn more and get started.

No Receipts Needed

Unlike a Flexible Spending Account, you can get reimbursed from your HSA without a receipt (although it’s a good idea to save these.)

Never Lose It

Your HSA is yours for life. It’s a great way to save for health expenses in the current year or future years. If you don’t use your full balance by year-end, it rolls over to the net year. You can take 100% of the balance with you if you leave the credit union or retire.

Change Your Contributions Anytime

Your HSA is flexible. You can access Paycom.com or the Paycom mobile app at any time to change your paycheck deductions.

Per Pay Period:

- Tax Free Employee Only $4,400 - the employer contribution. Total cannot exceed $4,400.

- Tax Free Employee + Dependents $8,750 – the employer contribution. Total cannot exceed $8,750.

HSA Employer Monthly Funding

Limited Purpose Savings Account

Employees may choose to enroll in a Limited Purpose Savings Account if enrolled in Regence 3500 HSA (HDHP) up to $3,400 to assist with pretax dental and vision expenses.

If you are an employee with a healthcare flexible spending account (FSA) and enrolling in the Regence 3500 HSA (HDHP) in 2026, you may either spend down your FSA no later than December 31, 2025, or you may roll over up to $680 into a Limited Purpose Savings Account (LPFSA)

HSA & Limited Purpose Savings Account - Additional Guides & Information

Flexible Spending Accounts (FSA)

A tax-advantage FSA is a great way to save money with pre-tax dollars to reimburse yourself for a wide variety of IRS-eligible health and/or dependent care expenses that are not covered through your other benefit plans. The annual amount you elect to contribute to each account will be divided into equal amounts and deducted from your paycheck pretax, therefore reducing your taxable income.

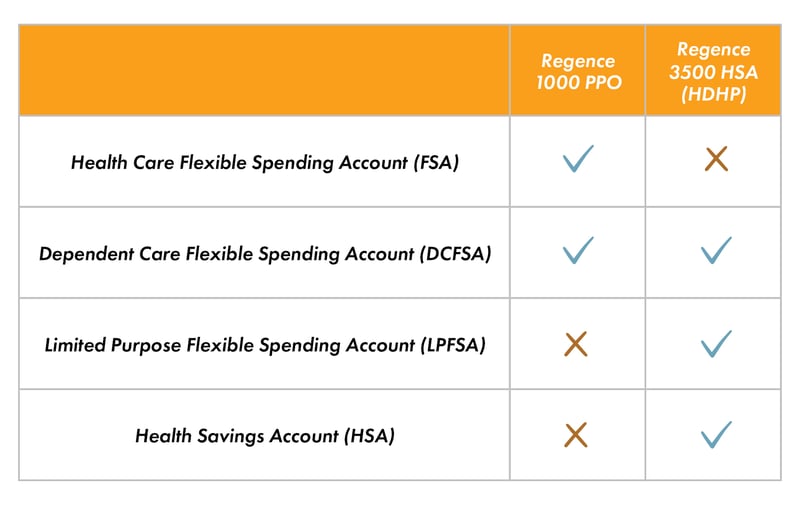

We Offer the Following FSAs

Healthcare FSA

• Pay for eligible health care expenses, such as deductibles, copays, and coinsurance. To learn more, visit Irs.gov and search for publication 502 or visit healthequity.com. To purchase eligible healthcare products, visit Fsastore.com.

• Contribute up to $3,400 (Amount will be based on the 2026 IRS limit).

• All funds must be used within the plan year or the funds are forfeited, except for a limit of $680 which may be carried over from 2026 into the 2027 plan year.

Dependent Care FSA

• Pay for eligible dependent care expenses, such as daycare for a child, so you and/or your spouse can work, look for work, or attend school full time. To learn more, visit Irs.gov and search for publication 503 or visit healthequity.com.

• Dependent Care FSA contributions for 2026 are $7,500 for single filers and married filing jointly, and $3,750 for those who are married and filing separately.

• Elections can be changed at any time via Paycom payroll elections.

How can you spend your money?

HealthEquity – Roll over amount for Healthcare Flexible Spending Account and new Limited Purpose Spending Account remains at $680 to roll over into 2027.

Healthcare FSA & HSA

• Eligible over-the-counter medications and products

• Braces

• Contact Lenses

If an employee has funds in a healthcare FSA they can roll up to $680 into a limited purpose FSA if they are moving to the high deductible plan in 2027.

Dependent Care FSA

• Nanny/Daycare

• Preschool

• Summer Day Camp

• Before or after school programs

• Help finding a Summer Camp or childcare

Elder Care (expand to learn more)

For elder care (or adult dependent care) to be eligible under a Dependent Care FSA, the person must meet one of these two criteria:

1. Qualifying Relative (the “tax dependent” route)

• They are your qualifying relative under IRS dependent rules (generally, gross income < $5,000 in 2025, you provide >50% support, and they are a relative), OR

2. Physically or mentally incapable of self-care + lives with you for more than half the year (the “incapable of self-care” route)

• The adult (e.g., parent, parent-in-law, grandparent, aunt/uncle, etc.) is physically or mentally not capable of self-care, AND

• They regularly spend at least 8 hours a day in your home (i.e., they live with you more than half the year).

This second option is the key one that allows many people to pay for elder care with a Dependent Care FSA even when the elder has too much income (Social Security, pension, etc.) to be claimed as a tax dependent.

Examples:

• Parent or parent-in-law living with you and needs daycare/adult day care because of dementia, frailty, etc. → Eligible even if their Social Security/pension makes them non-dependents for tax purposes.

• Parent living in their own home or in assisted living → Not eligible (they don’t live with you > half the year).

• Parent living with you but perfectly capable of self-care → Not eligible.

FSA - Additional Guides & Information

Flexible Benefits & Medical Plan Compatibility

Medical Leave & Supplemental Insurance

PAID FAMILY MEDICAL LEAVE

OREGON PAID LEAVE

WASHINGTON PAID FAMILY MEDICAL LEAVE

SHORT- AND LONG-TERM DISABILITY

Short-Term Disability benefits are provided to help offset loss of income that results from an accidental injury or illness. Coverage begins on the 8th day after an illness or injury and pays you 66 2/3% of your weekly earnings. Benefits are payable for up to 12 weeks. If your disability lasts longer than 90 days, our Long-Term Disability plan provides a source of income to protect you and your family for an extended period of time.

Keep In Mind: Benefits paid under CCCU’s STD plan will be reduced by benefits paid under any state disability program or any other eligible income offset as allowed by the state.

AFLAC

$50 wellness benefit, per plan. Employees that have multiple plans only need to file once and it will pay across their plans, per covered dependent.

Accident insurance supplements your medical plan by offsetting out-of-pocket medical expenses or other expenses arising from a covered accident.

Hospital Confinement

Hospital stays are expensive. The Hospital Confinement Insurance Policy can help ease the financial burden of hospital stays by providing cash benefits.

Critical Illness (Specified Health Event)

A lump-sum benefit is payable if you are diagnosed with a covered critical illness. The cash benefit can be used as you see fit.

2026 Aflac Elect Coverage

Critical Illness Coverage

Aflac - Additional Guides & Information

Life & AD&D

Basic Life and AD&D

You are provided with life and AD&D coverage at no cost to you equal to your annual base pay rounded to the next $1,000, up to a maximum of $200,000.

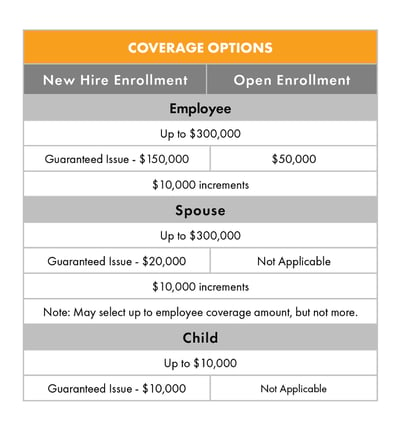

Optional Life & AD&D

You can buy additional Life and Voluntary AD&D coverage for yourself, your spouse and your eligible children. You pay for the cost of this coverage through after-tax payroll deductions*

Depending on the amount of coverage you elect, you may need to provide Evidence of Insurability (EOI) for Optional Life Insurance and Voluntary AD&D for yourself or your spouse. If it’s required, you will be informed during the enrollment process.

* The cost of Group Term Life and AD&D insurance is based on the employee’s age as of January 1st of the plan year.

Retirement Plans

*New for 2026*

If you are age 50 or over, earned $145,000 or more in FICA wages and want to make catch-up contributions, you are limited to after-tax Roth catch-up contributions beginning January 1, 2026.

401(k) Profit Sharing Plan

Our 401(k) plan helps you save for the future through flexible contribution options that fit your financial goals. You can start participating once you’re 18 years of age and have completed six months of employment.

For 2026, you can contribute up to $24,500 to your 401(k). If you’re age 50 or older, you can also make an additional $8,000 “catch-up” contribution, for a total of $24,500.

You can choose to make contributions on a pre-tax (Traditional) or after-tax (Roth) basis. Pre-tax contributions reduce your taxable income now, while Roth contributions are taxed up front and can be withdrawn tax-free in retirement.

Pre-Tax Employer Contribution

To support your retirement savings efforts, CCCU will contribute a flat 8% on all gross wages to your pre-tax 401k. You must be employed 6 months and be 18 years of age or older.

Vesting

In a retirement plan, vesting refers to ownership. Participants are always 100% vested in their own contributions to the plan. Employer contributions are fully vested after three years of vesting service. If you terminate employment before becoming fully vested, your non-vested employer contributions will be forfeited.

Enrollment

Prior to enrollment, you will attend an informational session and have access to one-on-one meetings with investment advisors through Principal Financial Group and OneDigital. Principal Financial Group will discuss their wide array of investment options and provide you with an overview of their website, where you can view and manage your account, make changes to your contribution elections, allocate funds in their various investment choices, and much more.

Secure Act 2.0 Employer Contribution

If you are interested in the Secure Act 2.0 Employer Contribution to a Roth Account, this is still not active, but we encourage you to reach out to Principal about a Roth conversion/transfer. This is something our plan allows and can be completed online under the contributions tab > last option "Roth Transfer".

401k Additional Guides & Information

401k Participant Fee Disclosure

401k Safe Harbor Notice

401k Summary Annual Report

401k Summary of Material Modifications

401k Summary Plan Description

Market Volatility Resource

Principal Learn Now Webinars

Principal My Virtual Coach

Principal Retire Secure Virtual

Principal Will & Legal Planning Services

Important Notice - Retirement Plan Investment Option Changes

Important Participant Notice Regarding Qualified Default Investment Alternative

Investment Option Summary

Medicare

Medicare Part D

Employees and eligible dependents age 65+ may be eligible for Medicare Part D prescription benefits outside of CCCU’s group plan, which could reduce out-of-pocket costs. Review our annual notice for how our coverage compares, key deadlines, and where to enroll.

Signing up for Medicare is an important part of planning for the future, but it can be confusing. CCCU has partnered with OneDigital to help with decision making.

2026 Business Plan

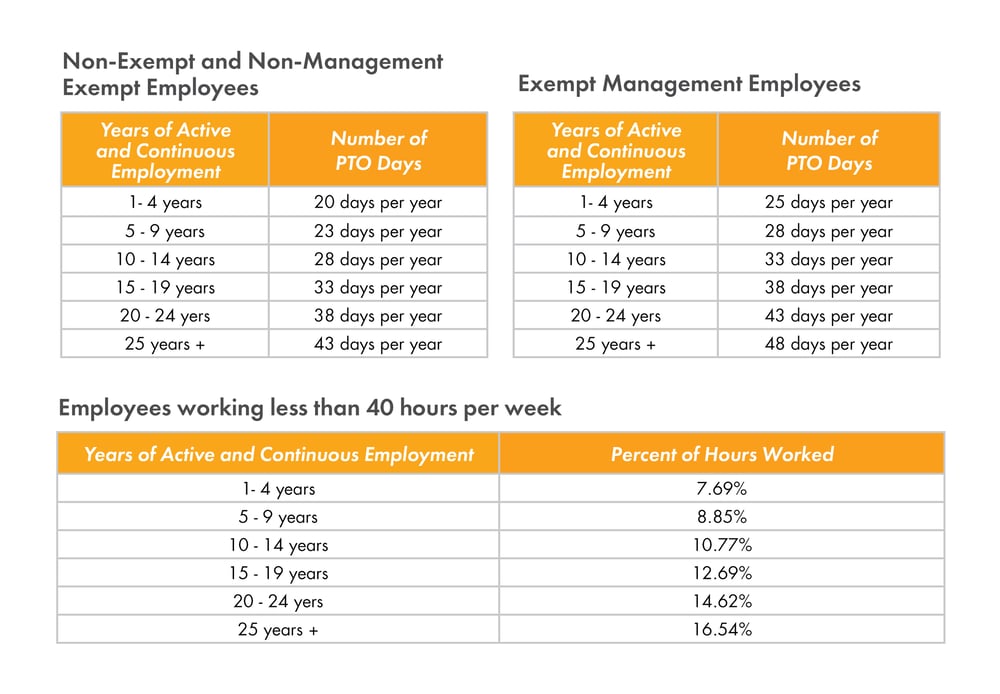

Paid Time Off

Celebrating YOU!

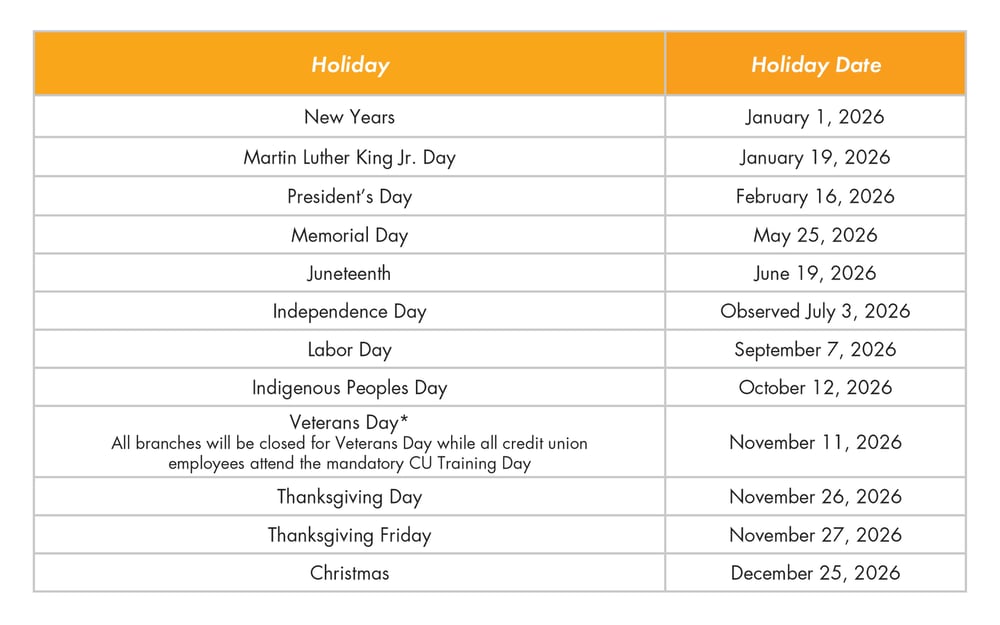

Holiday Pay

We recognize federal holidays observed by the Federal Reserve, unless the holiday falls on a Saturday or Sunday. When a holiday falls on a Saturday, we will observe the holiday on the Friday before. In the event that New Year’s Day is a Saturday, it will not be observed. Any holiday that falls on a Sunday will be observed on the following Monday.

Employees that celebrate a holiday not observed by the Federal Reserve may request to use PTO or unpaid time off for a holiday of a deeply held religious belief. For questions or accommodations, please contact a human resources representative.

Holiday Closures

Love Working at CCCU

We hope you enjoy working at CCCU as much as we love having you as a part of our team. Throughout the year, we enjoy “Love Where You Work” events to celebrate our employees and their achievements.

Select Employer Group Partner Perks

Enjoy employee store invitations and exclusive discounts from our SEG partners, Columbia Sportswear and Adidas.

Length-of-Service Program

We offer service awards and year-end bonuses to employees based on their years of employment with us.

The chart below represents the amounts for full-time employees working 30 or more hours per week. Part-time employees are paid at 50% of these rates.

CCCU Philanthropy

Local and Regional Efforts

We are deeply committed to local and regional philanthropy focused on supporting housing empowerment, family wellness and the opportunity to thrive within society. As a not-for-profit credit union, we focus on making our communities stronger, healthier places to live, work and raise families.

Who we support:

• African American Alliance for Homeownership (AAAH)

• Columbia Gorge Community College

• Columbia Gorge Food Bank

• Credit Union for Kids (CU4Kids)

• Hacienda CDC

• Emerging Leaders PDX

• Exceed Enterprises

• Hood River Education Foundation

• Hood River FFA

• Hood River Grad Project

• Hood River Lions Club

• Living Room Realty

• Proud Ground

• Randall Children’s Hospital

• Mercy Corp

• Metropolitan Youth Symphony

• Oregon Humane Society

• The Next Door, Inc.

• University of Portland

• Urban League of Portland

• Young CU Professionals of PDX (YCUP)

• Youth, Rights & Justice (YRJ)

African American Alliance for Homeownership (AAAH)

How we support AAAH:

Attend AAAH housing fairs, host virtual homebuying seminars, and participate in their day of service (a volunteer event where we help with home repairs and yard maintenance for those in need).

Financial Empowerment Collaborative (FEC)

How we support FEC:

We partner with four other local credit unions to offer financial wellness through the Urban League of Portland. This includes seminars, events, and one on one financial counseling for those in need.

Credit Union for Kids (CU4Kids)

How we support CU4Kids:

All proceeds from our Swag Wall are donated to CU4Kids on behalf of Doernbecher Children’s Hospital. We also host a staff and member CU4Kids fundraiser each year.

Youth, Rights & Justice (YRJ)

How we support YRJ:

We are a Platinum Sponsor for the YRJ Gala.

Helping Hands

Our workplace giving program, encouraging employees to support our community.

Volunteer/donation day

Need some time off to make the world a better place? We’ve got you covered!

Whether you're helping at a 501(c)(3) nonprofit or lending a hand at your favorite school, we love that you’re giving back to the community.

Once employees have reached 90 days of employment, enjoy 8 hours of time on us to volunteer and know that you're not just supporting a great cause, you’re spreading good vibes all around!

Go ahead, be a hero for the day, we’ll be here cheering you on the whole time.

Sponsored Volunteer Days

We’re excited to offer employees the opportunity to participate in CCCU Sponsored Volunteer Days. These special events, organized in collaboration with our philanthropic partners, typically take place over the weekend. Employees who volunteer outside of their normal working hours will have their volunteer time offset during the regular work week. Opportunities will be emailed to employees as they become available throughout the year. We encourage you to join the fun!

Special Discounts Just for You

Perks at Work

Discount Vision Program

Active&Fit Direct

Regence Advantage

Walgreens Smart Savings Discount

• Vitamins and supplements

• Allergy, cold and pain relief

• Eye care, dental care and baby essentials

• And more!

Working Advantage

• Select 'Become a Member'

• Create your account using your work email or company code: CCCU Perks.

Pet Insurance Discounts

30% off MetLife Pet Insurance.

Because they're family too.

Pet insurance helps you say “yes” to the care your pet deserves. Click below to explore your exclusive employee savings and keep tails wagging all year long.

Work Perks

Transit Reimbursement

Up to $75/month for public transportation expenses to and from work. Submit a reimbursement form and receipts to AP@consolidatedccu.com.

Educational Resources

Earn up to $500 per calendar year for approved expenses at an accredited school.

LinkedIn Learning

Interested in learning more? Please connect with your local library and speak with your manager about courses that will help you start building for tomorrow.

BAI

Ready to boost your leadership abilities? Dive into courses like ‘Project Management: The Basics’ or ‘Change Management – Coping with Change.’ Or, if enhancing your communication skills is your goal, explore ‘Telephone Techniques’ and ‘Optimizing Emails.’ At BAI, the world of learning is your fingertips.

Learn more at: Bai.org

Your Pay and Benefits

2026 Pay Schedule

CCCU employees are paid biweekly (every two weeks).

PDF Version

Benefit Deductions

- Most benefit deductions (medical, dental, insurance, FSA/HSA, etc.) are taken semi-monthly (twice per month).

- 401(k) contributions and loan repayments are deducted each biweekly paycheck.

Benefit Eligibility & Coverage Dates

When Benefits Begin

- Hired on the 1st of the month: Benefits begin on your hire date

- Hired after the 1st: Benefits begin the first day of the following month

When Benefits End

- Benefits continue through the last day of the month in which employment ends.

Final Paycheck

- Your final paycheck may include double benefit deductions to cover the full month of benefits.

- Deductions will never reduce pay below minimum wage or weekly salary thresholds, as required by law.

Earnings (Money You Receive)

Regular & Time-Based Pay

- Regular – Your standard hourly or salaried pay

- Overtime – Hours worked over 40 in a workweek (non-exempt employees)

- Double Time – Hours paid at twice your regular rate, when applicable

- Holiday Earnings – Pay for designated paid holidays

- Holiday Worked – Additional pay for working on a recognized holiday

- Inclement Weather – Pay when the credit union closes due to weather

- Inclement Weather Worked – Pay for working on site during a weather closure. Employees that can work remote are expected to do so and will be paid regular hours, unless hours are over 40 in a workweek, in which, see overtime.

- Jury Duty – Pay provided while serving on jury duty

- Volunteer – Pay for approved volunteer service time

Paid Time Off

- PTO Vacation – Exempt / Non-Exempt / PT – Paid vacation time used

- PTO Sick – Exempt / Non-Exempt / PT – Paid sick leave used

Allowances & Differentials

- Auto Allowance – Vehicle allowance provided for work purposes

- Language Differential – Additional pay for nonexempt employees for approved bilingual duties

- Exempt Language Differential – Language differential for exempt employees for approved bilingual duties

- Taxable Fringe Benefit In/Out – Taxable non-cash benefits, ex. Gift card

Bonuses & Incentives

- Incentive – Performance-based incentive payment

- Commission – Earnings tied to sales or production

- Year-End Bonus – Discretionary annual bonus based on CCCU performance

- Service Award – Recognition award for service milestones

- Leadership Bonus – Bonus tied to leadership performance

- Department Bonus – Department-based bonus

- Merger Bonus – Bonus related to merger activity

Other Earnings

- Bereavement – Paid time for an approved bereavement event

- Birthday – Birthday pay, if applicable

- Deferred Overtime Compensation – Additional overtime calculated at a later date, due to commission/incentives

- Retro Earning – Back pay or payroll corrections

- Group Term Life – Taxable value of employer-paid life insurance

- Merger Payment – Payments tied to merger agreements

Deductions (Money Taken Out)

Retirement & Savings

- 401(k) EE % – Your 401(k) contribution as a percentage of pay

- 401(k) EE $ – Your 401(k) contribution as a flat dollar amount

- 401(k) ER Contribution – Employer contribution to your 401(k), equal to up to 5%

- 401(k) Safe Harbor ER Contribution – Required employer safe harbor contribution, equal to 3%

- 401(k) Loan Deduction 1 / 2 / 3 – Repayment of 401(k) loans

- Roth EE % – Roth contribution as a percentage of pay

- Roth EE $ – Roth contribution as a flat dollar amount

Medical, Dental & Insurance

- Regence Medical 1000 / 3500 (EE) – Employee medical premium

- Regence Medical 1000 / 3500 (ER) – Employer medical premium

- Delta Dental (EE) – Employee dental premium

- Delta Dental (ER) – Employer dental premium

- Willamette Dental (EE) – Employee dental premium

- Willamette Dental (ER) – Employer dental premium

- Employer Paid Life / AD&D – Employer-paid life and accidental death coverage

- Employer Paid STD – Employer-paid short-term disability

- Employer Paid LTD – Employer-paid long-term disability

- Voluntary Life – Employee / Spouse / Child – Optional life insurance premiums

- Voluntary AD&D – Employee / Spouse / Child – Optional AD&D premiums

- Accident – Accident insurance premium

- Hospital Indemnity – Hospital indemnity insurance premium

- Critical Illness – Employee / Spouse – Critical illness insurance premium

Health & Dependent Accounts

- Healthcare FSA – Pre-tax healthcare spending account

- Dependent Care FSA – Pre-tax dependent care spending account

- HSA Employee – Employee HSA contribution

- HSA ER – Employer HSA contribution

Leave & Other

- Paid Family Medical Leave (PFML) – State-required employee contribution. 60% of 1% of taxable wages.

- PFML ER Contribution Memo – Employer PFML contribution (informational only)

- Expense Reimbursement – Non-taxable reimbursement for approved expenses

- Miscellaneous – Rare or one-time deductions

HR & Benefit Vendor Contact Information

CCCU Human Resources

Kate Montgomery

HR Manager

602.750.5537

Leslie Wooden

HR/Admin Assistant

503.872.9448

HR Hotline

503.797.7597

Dental Insurance

Willamette Dental Group

T: 855.433.6825

W: willamettedental.com

Moda Dental

T: 888.217.2365

E: customersupportOR@deltadentalor.com

AFLAC

Aflac District Manager

Joe Foxley

T: 907.982.7828

E: Joseph_Foxley@us.Aflac.com

Claims Administrator

Mary Baskin

T: 334.540.4001

E: mbaskin@communicorp.com

Benefits & Retirement Brokers

Selina Davis

T: 408.649.4747

E: selina.davis@onedigital.com

Retirement Broker

Ashley Butz

T: 971.236.4836

E: ashley.butz@onedigital.com