No matter your income, wealth, job, or socioeconomic status, most adults will borrow money at one time or another. Whether it's to start a business, pay for college, or buy a house, getting funding from a lender is often the name of the game.

Having said that, there are many ways you can borrow money, and not all are created equal. So, what kind of loan should you get, and from what type of lender? Read on to learn more.

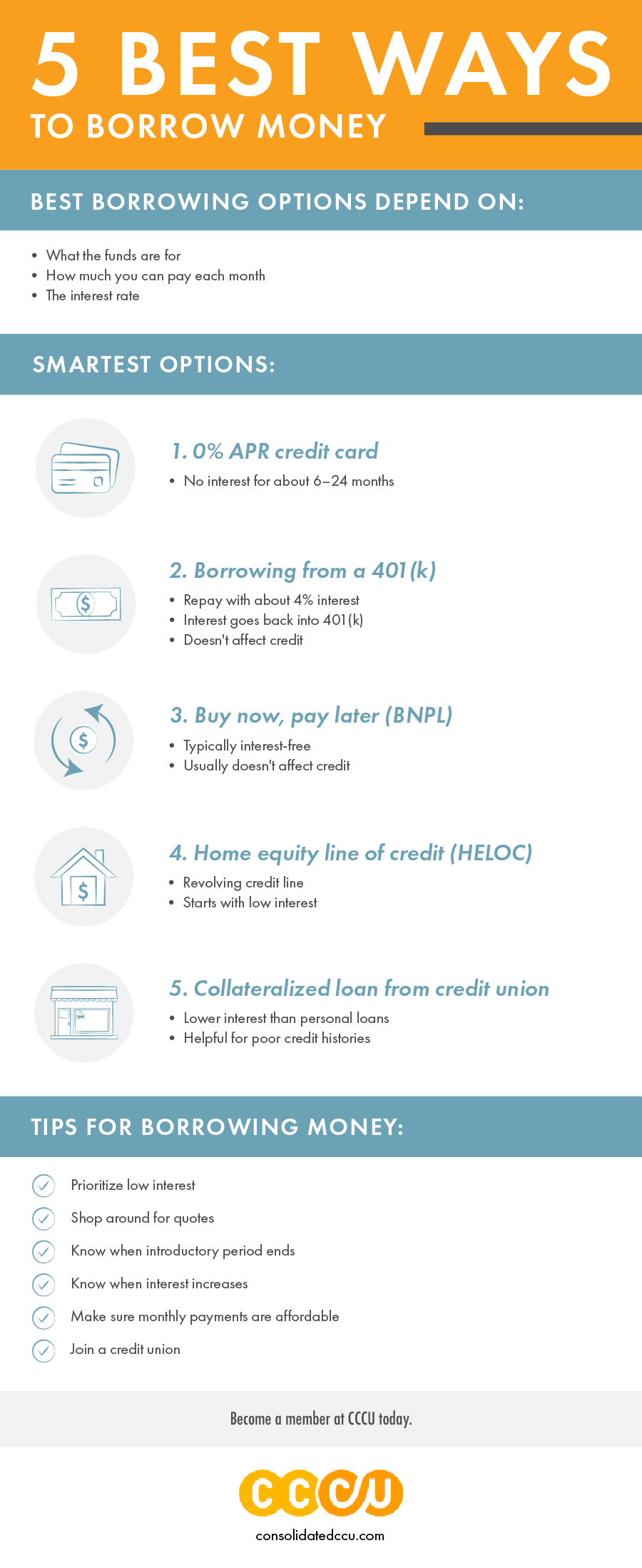

What is the smartest way to borrow money?

The smartest way to borrow money depends on what you need the funds for, how much you can pay toward the balance each month, and the borrowed fund’s interest rate. When managed properly, a few of the best funding options include:

- 0% APR credit card

- Borrowing from a 401(k)

- Buy now, pay later

- Home equity line of credit

- A personal loan from a credit union

0% APR credit card

A 0% annual percentage rate (APR) credit card means you won't have to pay interest on purchases for an initial period. That period could be anywhere from six to 24 months.

If you're able to manage your money and pay off the balance within the time frame, this can be a good way to borrow money because you'll avoid paying interest. Just bear in mind that after the introductory period, your APR could jump to 20% or higher.

Borrowing from a 401(k)

If you have a 401(k) retirement plan through your employer, you could borrow money from that account. However, you'll typically have to repay it with an interest rate of about 4%.

In addition to the relatively low interest, the good thing about this borrowing option is that you pay the interest back to yourself. When managed properly, money paid goes back into your 401(k), along with the funds you borrowed. What's more, borrowing from your 401(k) won't affect your credit. Just remember that you must have funds available in your 401(K) with contributions from either you or your employer to be able to borrow from the account.

Buy now, pay later

If you've shopped online within the last few years, you've probably come across a buy now, pay later (BNPL) option at checkout. This ecommerce solution lets you order products immediately and pay for them, typically in four equal installments due every two weeks.A few of the most common include Affirm, Afterpay, and Klarna, which are often interest-free. In some cases, a BNPL installment may not even appear on your credit report.

This is a relatively low-risk way to borrow money, if managed correctly. However, doing it too often within a short period could leave you with a substantial amount to pay each month or can lead to overspending.

Home equity line of credit

A home equity line of credit (HELOC) works like a credit card. Like a credit card, a HELOC is a revolving credit line that you pay interest on the portion of the line you use. It allows homeowners to continuously access funds through a line of credit and repay them. HELOC terms vary per institution, but typically begin with a 5-10 year draw period. This is followed by a 10-20 year repayment period where you must pay back principal and interest to satisfy the loan.

Typically this type of lending starts with a lower interest rate than traditional home equity loans, but there is a slight amount of unpredictability as the interest rate can change as often as every six weeks. This change is dependent on Federal Reserve actions.

At CCCU, we offer fixed rate HELOCs. This fixed rate protects you against these market fluctuations that impact rates. All that said, getting a home equity line of credit from a credit union like CCCU will ensure a competitively low interest rate while giving you the most flexibility.

Collateralized loan from a credit union

Finally, a good option is a collateralized loan. Collateral is an asset, such as a car or home, that you offer up as a way to qualify for a particular loan. This option can be helpful for borrowers to obtain loans if they have poor credit histories.

Though you could get a loan from a large bank, you're wise to consider borrowing from a credit union. As member-owned nonprofit financial institutions, credit unions often offer lower interest rates. Since credit unions serve members all earnings are returned to credit union members.

What are good tips for borrowing money?

When borrowing money, keep the following pointers in mind: 1. Prioritize lenders or borrowing methods that offer the lowest interest rates.

2. Shop around for quotes on interest and repayment options.

3. Be mindful of introductory periods and increasing interest rates.

4. Properly manage your finances. Make sure you're able to afford the payments before borrowing funds.

5. Join a community credit union to take advantage of the low rates and flexible lending options offered to members.

Work with CCCU and borrow with confidence

At CCCU, we're committed to supporting our members' financial journeys, no matter what life stage they're at. That's why we offer a range of smart lending options, including low-interest auto loans, Visa credit cards, mortgages, and HELOCs.

We proudly serve people who live, work, worship, own a business, or and attend school in Multnomah, Clark, Washington, Hood River, Clackamas, and Yamhill, Columbia, and Skamania counties, or are a relative of a current member. We have three physical branches in Portland and one in Hood River, convenient mobile banking, plus access to 5,600+ CO-OP Shared Branches and over 30,000 surcharge-free CO-OP ATMs nationwide!

Become a member at CCCU today.