You missed a mortgage payment. It happens. While it isn’t the worst financial mistake, it is a little more serious than being late on other types of accounts. So, how does a late payment affect your credit score, and what should you do if you miss one?

Late mortgage payments and credit scores

The consequences of a late mortgage payment depend on a few factors, including your lender's policies and how delinquent the account is. With that said, CCCU is here to offer insight into what's considered late, what could happen next, and what steps you can take to remedy the issue.When is a payment considered late?

Mortgage payments are typically due on the first of the month, though lenders often have 15-day grace periods. This means you have up until the 15th—or potentially the following business day if it lands on a weekend—before it's considered late. All that said, a late payment usually will not show up on your credit report unless it's 30 or more days past due.

What happens if you miss a mortgage payment?

If you're late on your home loan but pay it sometime between the 16th and the last day of the month, it most likely will not affect your credit. However, you could face other penalties from your lender. Like credit card issuers, cell phone companies, and utility providers, mortgage lenders often charge a fee for late payments. While the amount varies, you could have to pay up to 5% of the overdue amount. For example, if your monthly payment is $2,000, you might owe an additional $100. The late fee should be noted in lending documents, and you might be able to find it by signing into your account.

How long do late payments affect your credit?

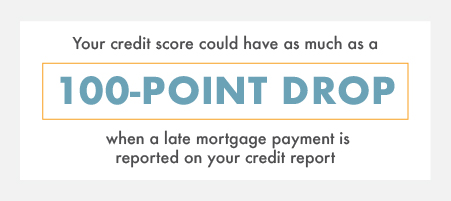

A late mortgage payment reported on your credit report could mean as much as a 100-point drop in your credit score. The negative mark will stay on your report for up to seven years, though it won't necessarily weigh down your score for that long. This all depends on your previous score, your credit history, and exactly how late the payment was.

If you're late multiple times or miss several consecutive mortgage payments, you can expect more severe and long-lasting consequences. Additionally, you could face foreclosure, which also goes on your credit report.

What to do if there's a late payment on your credit report

Being late on your mortgage is a relatively serious concern, but the good news is that recovery is possible. Here are a few things you can do to make up for a missed payment:

- Pay any past-due accounts as soon as possible so everything is current.

- Make sure to pay future mortgage payments on time, along with all your other bills.

- Work on paying down other debts to decrease your credit utilization ratio. Keeping it under 30% is good, but less than 10% is ideal.

- Consider writing a "goodwill letter" to your lender asking them to remove the late payment from your credit report. The odds of this working may not be in your favor, but it's not unheard of.

Depending on where you started and how diligent you are, rebuilding your credit could take months or potentially years. In any case, striving for a good credit score is definitely a worthwhile effort.

Mortgage solutions from our Portland-based credit union

At CCCU, we believe managing your personal finances shouldn't be complicated or stressful. Our one-stop shop community credit union offers a range of mortgage programs and tools. We're talking traditional home loans, adjustable and fixed-rate mortgages, and FHA loans with up to 30-year terms, plus first-time homebuyer savings accounts and home equity lines of credit.

We serve people throughout the Portland metro area and the surrounding counties, including Hood River. Members enjoy low interest rates, mobile banking, easy bill-pay solutions, nationwide ATM access, and personalized services. Contact us to learn more!