Buying a Home on a Single Income: What You Need to Know

Blog Highlights: You can absolutely buy a home on one income. Start by knowing your budget, checking your credit score, ...

Read More

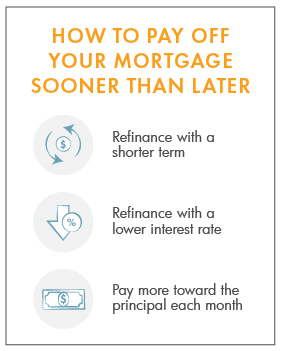

For lots of new homeowners and prospective buyers, the mortgage pay-off date is so far away that it hardly seems real. However, you're wise to keep your golden years in mind when making money moves.

Like many others who own their homes, you might be wondering, “Is it smart to pay off a mortgage before retirement?” There's no one-size-fits-all answer to this question, but our Oregon community credit union broke down the key considerations to help you decide what's best..jpg)