-

Budgeting: Learn how to create a realistic retirement budget with a fixed income that keeps your financial goals on track.

-

Saving: Discover practical ways to cut costs and take advantage of money-saving opportunities in retirement.

-

Protecting: Find out how to preserve your nest egg by limiting debt, planning for future costs, and making intentional spending choices.

Maximizing your retirement isn't just about how much you've saved – it's also about how wisely you spend. Preserving your nest egg requires mindful budgeting, prioritizing needs over wants, and making intentional choices that stretch your savings for the long haul. After all, you're entitled to celebrate your success, and with smart spending strategies, you can enjoy the retirement you've worked hard for while maintaining financial peace of mind.

How to Maximize Your Nest Egg with Smart Spending Habits

Create a Realistic Retirement Budget

Making and sticking to a budget in retirement helps ensure your savings lasts while you get to live the lifestyle you want (and deserve). Set yourself up for success by planning monthly expenses around your fixed income sources – being realistic about what you can afford is crucial for maximizing your nest egg. Monitoring spending habits ensures you can live within your means while maintaining financial peace of mind.

Helpful Tip: Use a budget calculator to help you get a better idea of where your money is going and how much you have leftover.

Enjoy our budgeting and money-saving tips to improve your budget by downloading our free guide:

Track Spending to Stay Accountable

Savvy retirees should make it a practice to regularly monitor where their money goes and adjust spending habits as needed. There are a variety of good budgeting apps that'll help keep your spending on target.

Downsize to Reduce Costs

Often in retirement, many people find that their home can offer financial opportunities. Selling your home may be a good financial move if you're planning to relocate to a new area, travel, or simply want to downsize your living space for ease and convenience. Downsizing in retirement can help reduce housing costs, free up income, and protect your financial reserves.

Helpful Tip: Depending on your financial situation, and whether you own your home or still have a mortgage, it may be wise to evaluate all your options. If you own your home and have available equity, you could gain access to cash with a Home Equity Loan or Home Equity Line of Credit (HELOC) to help reduce debts, cover healthcare costs, and cover certain expenses. This option gives you an alternative cash source as opposed to dipping into your retirement savings.

Explore Everyday Money-Saving Solutions

Always be on the lookout for money-saving solutions that you may not be aware of.

-

Use coupons, reward programs, and search for deals and sales. Shopping on "senior days," is a savvy money-saving move!

-

Plan meals ahead of time, buy store-brand items, and consider frozen fruits and vegetables for added savings.

-

Reduce or eliminate subscription services and memberships that you aren't using.

-

Check your local library for free resources for entertainment, community events, and more.

-

Negotiate a better rate for your cell phone, internet, insurance, and other services. Some may even offer a special discount for seniors.

-

Consider joining organizations like AARP, which offers member-only discounts on a wide range of products and services.

Helpful Tip: Research eligibility requirements for senior government programs that offer assistance with food, housing, health, and more.

Build a Healthy Relationship with Money

Retirement is a time to enjoy life and do the things you've always dreamed of. Don’t feel guilty about enjoying your Golden Years and spending your money to do it. Instead, plan your spending for meaningful experiences while staying mindful of your financial limits. You can have the best of both worlds with smart spending choices and good planning during retirement.

Preserve Your Nest Egg

There are a few things you can do to ensure your money lasts throughout your retirement. The key is to limit your debt as much as possible, which can be done by budgeting and thoughtful planning. One important expense we incur as we get older is healthcare costs. Planning now for this expense and being prepared is a smart way to avoid havoc on your financial situation should an emergency arise.

-

Review Medicare options to ensure you have a full understanding of Medicare A, B, and D, as well as supplemental options.

-

Consider opening a Health Savings Account (HSA) if you have high-deductible health plans. HSAs offer a tax advantage and are a way to save for qualified medical costs.

-

Prioritize preventive care and stay on top of routine check-ups, screenings, and vaccinations to prevent more serious and expensive health issues down the road.

-

Look into long-term care insurance to protect your savings from potentially high costs for services like assisted living, in-home services, or other continuing care needs.

Making it a point to live within your budget is crucial for long-term stability. Be sure to consult with trusted professionals who can properly guide you.

Preserve Your Retirement Nest Egg with CCCU Wealth Management

You've worked hard to build your nest egg with long hours and thoughtful savings over the years. Making smart money choices and creating healthy spending habits while you are retired is key. CCCU Wealth Management can help you prepare for and seek confidence in your retirement. Through our detailed planning process, we will work to shelter and grow your nest egg at the same time. Contact us today to discuss how you can best preserve your money and so you can enjoy retirement!

Securities are offered through LPL Financial (LPL), a registered broker-dealer (member FINRA/SIPC).

Insurance products are offered through LPL or its licensed affiliates. Investment advice offered through CCCU Wealth Management Inc, a registered investment advisor and separate entity from LPL Financial. Consolidated Community Credit Union and CCCU Wealth Management are not registered as a broker-dealer or investment advisor. Registered representatives of LPL offer products and services using CCCU Wealth Management, and may also be employees of Consolidated Community Credit Union. These products and services are being offered through LPL or its affiliates, which are separate entities from, and not affiliates of, Consolidated Community Credit Union or CCCU Wealth Management. Securities and insurance offered through LPL or its affiliates are:

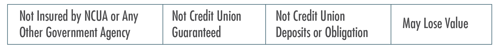

|