Financial health can seem out of reach to many. Understanding how to evaluate where you are, plan for the future, and achieve your goals starts with an honest consideration of your relationship with money. This piece will help you learn about yourself and your relationship with money. It will then guide you through taking the next steps to heal your relationship with money.

Money is a hard thing to talk about. Some of us were raised to understand that talking about our finances is, in fact, rude or taboo. Without these crucial conversations and learning opportunities, you may have grown up without a healthy relationship to money, or simply haven’t evaluated your relationship with your finances at all. No matter how you grew up, money shapes how we live our lives and see the world. Taking the time to examine your relationship with your finances can be revealing and difficult, but it can help you move forward in a productive way to meet your financial goals.

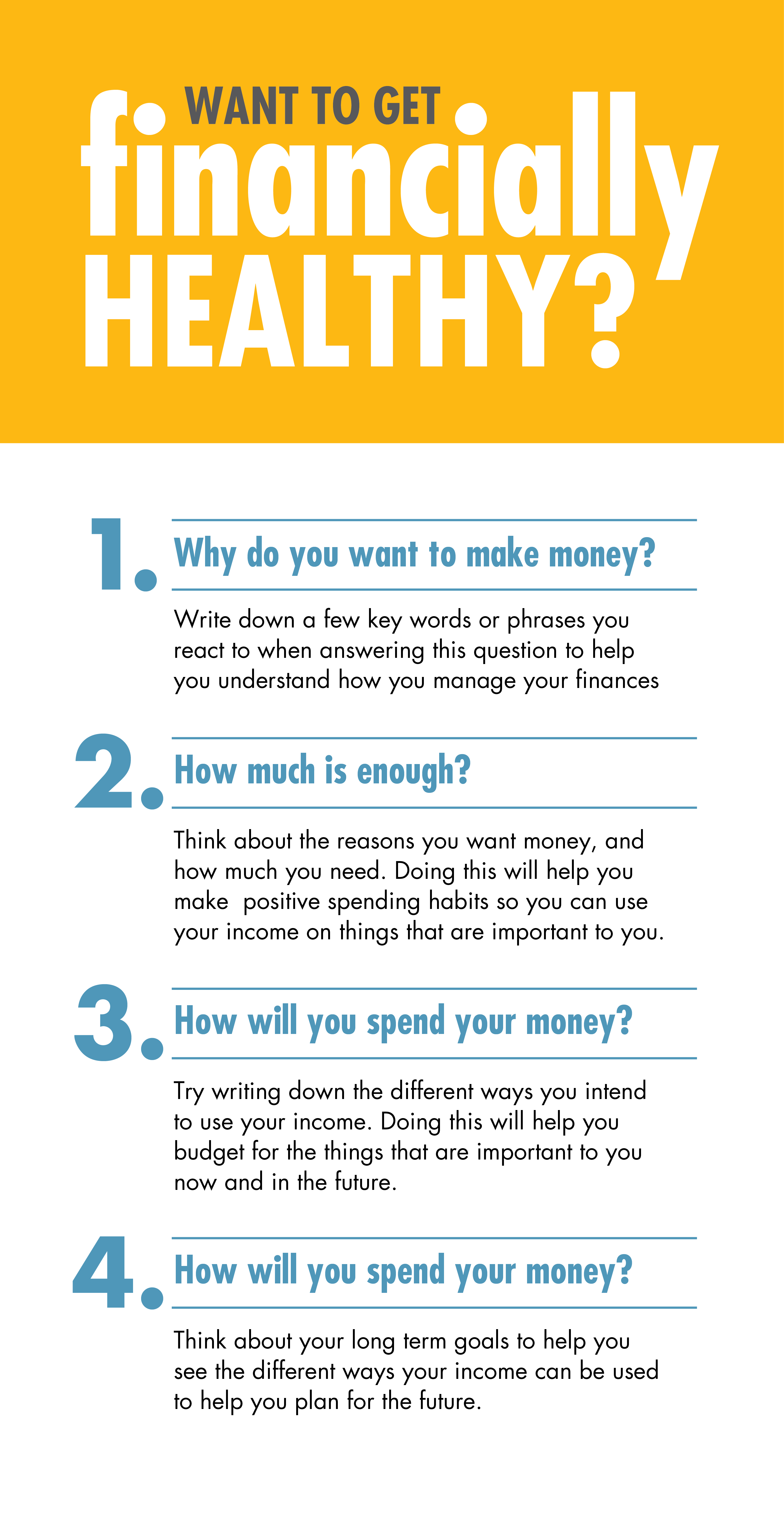

So, in this piece, we’ll be exploring four questions that can help you evaluate your financial health to improve your connection with your finances. It may also be helpful to ask a family member or loved one to support you through this activity as a bonding exercise as well. Having someone with you through this introspection and connection will help alleviate guilt around your financial well-being. So, ready to get started? Let’s start the conversation.

1. Why do you want to make money?

You might be asking yourself, “Why do I want to make money?” To live, of course! But why else? Our relationship with money is often shaped by our upbringing, and how we see our guardians, friends, and family use it. We may have learned healthy spending habits growing up, or made choices that didn’t serve us or those around us in a good way. It’s also important to take into consideration that everyone grows up with different relationships and experiences around spending, which means we have to approach this question on an individual basis.

Write down a few keywords or phrases you react to when answering this first question to help you understand how you’re managing your finances. You can also share your answers with someone you trust if you need a little help.

2. How much is enough?

How much you need to live on vs. how much you want is always a healthy question to ask yourself. Answering questions like these will help you plan for a healthy financial future. Above all, knowing the what and whys around your spending can improve your relationship with what you earn. Interrogate yourself about the amount you decide you want to make. Why do you need that much? Is that amount what you want before or when you have kids, buy a home, travel, etc.? Examining the reasons you need to increase your earnings–and by how much–helps you create positive spending habits around things that are important to you.

However, many of us use money as a barometer for our successes. It’s important to reflect on that inclination and think about whether we’re doing okay monetarily right now. Take a step back and ask yourself about your financial goals and where they come from. Doing this exercise helps us get a clear understanding of our motivations around our spending.

3. How will you spend your money?

What do you use the money for? What do you want or anticipate needing it for? You could use it to contribute more to an emergency fund, a home, or an adventure of some kind. You may also want to make donations to an organization you admire. Each of these are healthy and understandable ways of using your income that improve your well-being. Thinking about the different applications for what you earn can help you plan your spending around things that are important to you. Doing this will also display ways you can budget to make these things more affordable to you in the future.

4. What legacy do you want to leave?

Think about your long-term goals to help you see the different ways your income can be used to help those in the future. You may decide you want to leave behind money to your children for financial support, make a charitable donation or contribute your earnings to a special trust. Thinking about your long-term goals for supporting those you love will allow you to zoom out and see the different ways your wealth can be used. Similarly, this can help you plan for the future in a number of helpful ways.

What are your next steps now that you’ve answered these tough questions? Start by making a budget and a clear plan for the next year. Doing this will help you stick to the values and conclusions you may have learned by answering these questions.

Get an accountability buddy to help you with the next step toward increasing your financial literacy. You can check in with them once a quarter and see how are you progressing towards your goals. Being connected to others through this process helps alleviate the pressure and taboo that money has in our society, and will get you one step closer to the legacy you’re committed to leaving.

Curious about the best ways to save and invest your money? Consolidated Community Credit Union is here to help. Whether you’re looking for a high-yield checking account, saving for a home, or thinking about starting a business, we can help. Learn more here.