"Financial literacy" is a term that's thrown around a lot. But what does it mean exactly and how do you stack up? Our Portland community credit union is here to offer questions to ask yourself while helping your brush up on your personal finances.

What does it mean to be financially literate?

Financial literacy means having a basic understanding of the main components of personal finance. This knowledge can help you stay out of debt, confidently make money-related decisions, grow your wealth, and maintain long-term financial wellness.

Financial questions to ask yourself

Here are a few financial questions to ask yourself to gauge your financial situation and see where you are. It’s also a good idea to review your finances at least once a year or during major life changes.

Do you know your net income?

A critical piece of financial literacy is knowing how to calculate your net income. Whether you earn money from a salary, hourly wages, or payments from a side hustle, it's what you take in minus taxes and business expenses.

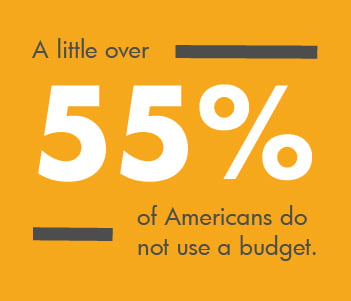

Do you maintain a budget?

Do you maintain a budget?

A little over 55% of Americans do not use a budget. However, knowing how much you're spending, where your money goes, tracking your expenses, and planning how to allocate your income are vital aspects of being financially literate.

Are you using credit cards responsibly?

Credit cards often get a bad rap, though this mostly has to do with high interest rates, recurring fees, and the consequences of using them irresponsibly. A financially literate person knows how to shop around for the best credit card rates and that paying off the balance every month is the best way to boost their score. With CCCU's low-APR Visa cards, you won't pay any annual fees, plus you'll earn rewards every time you make a purchase.

Do you know when to invest in real estate?

The decision of whether to rent or buy a home can be confusing and overwhelming. Knowing when to invest in real estate means you have at least somewhat of a grasp on the housing market. Additionally, you should have a rough idea of the interest rate you can get with your credit score and how much you can save on a mortgage when you qualify for a lower rate.

Are you a master of your credit score?

To be financially literate, you need to educate yourself about your credit score. Get to know the different factors that impact your rating and what could be negatively impacting your credit. Also, while your rating can fluctuate monthly (or even weekly), you should have a relative idea of where you stand.

Are you saving for retirement?

Knowing how important it is to save for retirement is a crucial part of financial literacy. It's never too soon (or too late) to start investing in your golden years, so be sure to sign up for your employer-matched 401(k) plan or open a traditional or Roth IRA account on your own. If you need a motivational boost, we recommend familiarizing yourself with the phenomenon of compound interest.

How banking with a credit union can help

You don't need to have a pro-level understanding of each of these concepts to be financially literate. But now that you have an idea of how important they are, you might be inspired to spruce up your personal finances.

Our Portland credit union believes in simplified banking that's accessible for everyone. From low-interest credit cards and mortgage loans to high-yield savings accounts and automatic bill-pay, we have all the tools you need to achieve and maintain good financial health.

We proudly serve people who live, work, worship, own a business, or attend school in Multnomah, Clark, Washington, Hood River, Clackamas, and Yamhill, Columbia, and Skamania counties, or are a relative of a current member.

We have three physical branches in Portland and one in Hood River, convenient mobile banking, plus access to 5,600+ CO-OP Shared Branches and over 30,000 surcharge-free CO-OP ATMs nationwide!

Join us today!